welcome to the

blog

Hey friends! Thank you so much for stopping by! Not only will you find incredible information about our guests, but also amazing resources to help you reach your money goals!

featured post

Episode 09: Building your Business with Jaclyn Johnson founder of Create and Cultivate

Read the post

March 29, 2021

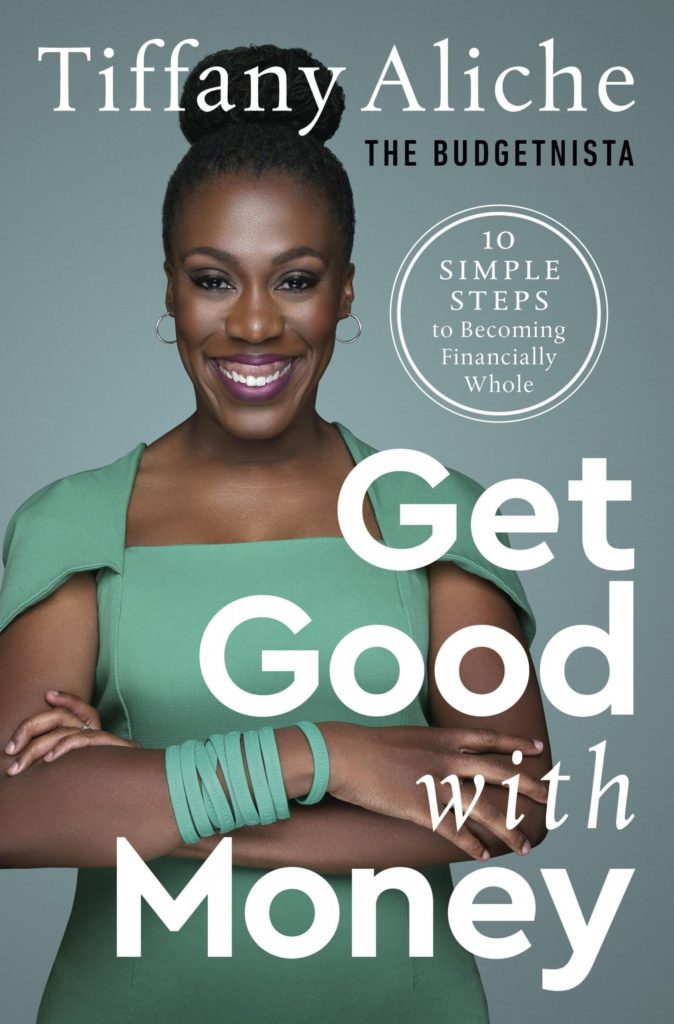

Get Good With Money with Tiffany ‘The Budgetnista’ Aliche – Episode 39

This week we have one of our favorites, Tiffany ‘The Budgetnista’ Aliche, on to talk about her new book, “Getting Good With Money”. This is Tiffany’s third time on the podcast because she is that good!

Tiffany was on just a year ago to talk about her children’s book, “Happy Birthday Mali More”. She is now working on the animated version of Mali and her Youtube channel for those stories.

The subtitle to “Get Good With Money” is ’10 Simple Steps To Becoming Financially Whole’. This book gets back to the basics of financial education. Financial education is so important to Tiffany she even helped create a law to get financial education to be a part of Middle Schools in New Jersey.

Tiffany gives some easy tips on improving your credit score. Designate a credit card for one specific small bill every month and pay it off in full. She also explains how to piggy back onto someone else’s credit too.

For budgeting, Tiffany shares ways to budget without budgeting. You can set up direct deposits into four separate accounts. Two checking accounts – one for spending and one for bills. Two savings accounts – one for emergencies and one for goals. Split it before you get it.

Tiffany wrote this book thinking of people who are differential learners. Being a teacher, she always thought of all the different ways and levels of knowledge that people reading this will have.

Tiffany also shares all about the different people that might be a part of your financial team. Even if you don’t need all the different team members, you should have an accountability partner. Whether it’s a spouse or parent or close friend, you need someone who will support you and not shame you.

In addition to questioning to whether or not you need a CPA or an Estate Planner, you also need to see if they will be a good fit. She gives tips and things to look for and ask yourself before hiring someone.

Tiffany attributes her gift of teaching to the 10 years she spent teaching preschool. It was all about teaching those basics and she learned how to best navigate all of their different levels. It makes her very affective now with adults who are at all levels.

We also talked about the gender wealth gap and the racial wealth gap. It’s frustrated being underpaid doing the same things as other people doing the same things.

Tiffany shares a little about her financial picture. She also tells us about an experience she went through in possibly taking money out of her home. It’s commonly known that black homeowners get appraised at a lower rate.

The appraisal Tiffany got back seemed low. She got another opinion. Someone from the New York Times did a story about it. After getting an independent appraiser to come and give another appraisal, they found that the first appraiser did some things that were definitely not accurate.

Tiffany shares about how because of the bad appraisal and not taking that money and investing into it then it’s lost money from lack of investing. Now Tiffany is helping to write a law to make it illegal to appraise someone’s house based on their race. Also, the realtor and appraiser will make it clear and known where you can go if you feel like your house was appraised inaccurately.

Hopefully, this law will soon be passed and even get federal attention. Other states have already started adopting laws similar to their financial literacy for children law.

Even though Tiffany was unsure about being on the cover of her book, she’s glad her publisher talked her into it. We are so glad too, she’s a great example for all women.

One of the reasons we love Tiffany is because of her empathy and kindness. She doesn’t believe in bringing shame and blame to people over their financial situations.

You can find her book, “Get Good With Money” at the website for the book – www.getgoodwithmoney.com

And you can find her everywhere as “The Budgetnista” – www.thebudgetnista.com

Find her on Instagram at www.instagram.com/thebudgetnista/

Episode 8 – Budgeting Basics and Beyond

Episode 24 – Financial Education For Children